Elto Blog

How Good is Apollo.io Sales Intelligence Data?

Choosing the right data provider is tougher than ever, especially with Apollo's recent gains in its self-serve Sales Intelligence tool. We evaluated it to see how it stacks up.

As long as salespeople have been cold-calling (or cold-telegramming, or cold smoke-signaling), getting prospects' contact information has been the killer of good funnels. And while breakthroughs in science and technology have brought us superintelligent chatbots, drugs for Parkinson's, and monumental achievements in the arts, we're still hitting as many bad numbers today as our ancestors were, despite the rise of dozens of major data providers.

It's no surprise, then, that one of the biggest questions we get from users is "Which data provider do you recommend?" There's definitely no easy answer, and we've seen clients succeed with every one of the major tools. Given Apollo's meteoric rise as a platform-of-choice for thousands of startups and agencies, though, we wanted to take a deeper look at how its data holds up.

Let's dive in.

Apollo Sales Intelligence — What is it?

Apollo's Sales Intelligence product is a giant (270M+ records, as per their own count) B2B contact database. Unlike other data providers, Apollo's data platform is self-serve, and works seamlessly with its suite of products, including its native email sequencer, dialer (considering the dialer? check out our article here), and automations.

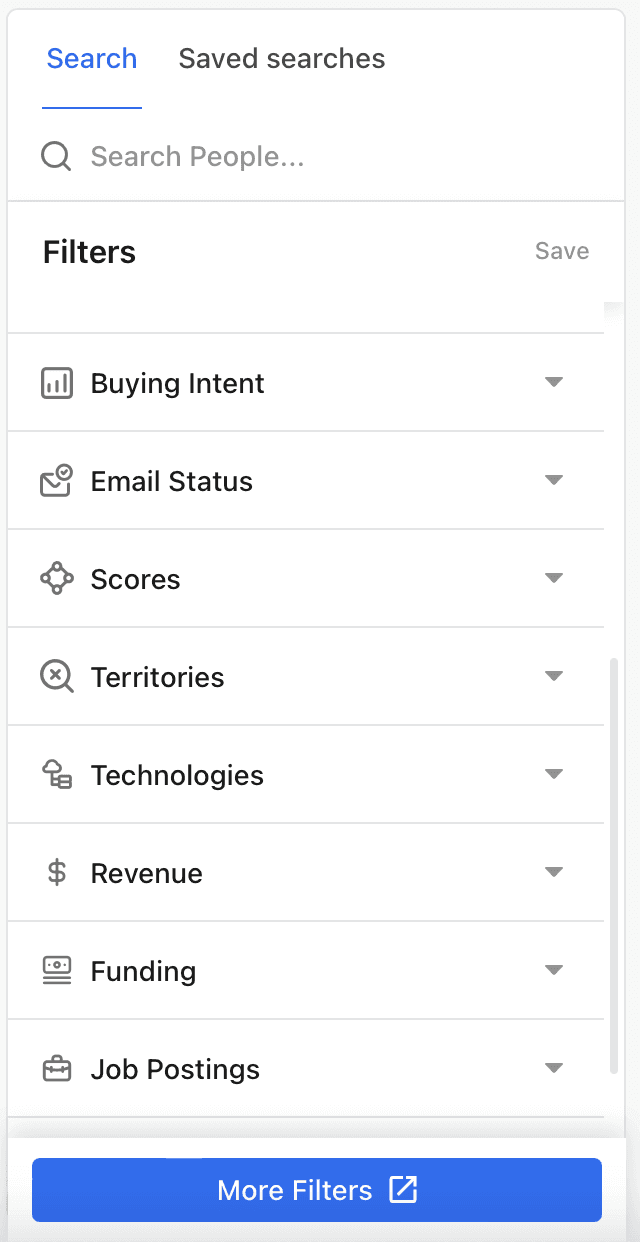

Apollo's database includes phone numbers, emails, buyer intent signals, and more, and is filterable by a sizable collection of parameters.

Apollo's contact DB filters — we found that the sophistication of its filters made Crunchbase unnecessary.

How good is the data?

We're setting up a head-to-head contest across all of the data providers for a proper quantitative treatment of this question. For the moment, though, we ran a small-scale experiment with some of our own data — namely, comparing the contact information of 100 Sales Development Managers between Apollo and another data provider (Lusha) that we use heavily.

The results were in Apollo's favor, though not significantly so. We found that Apollo had broader coverage than Lusha, though each was missing numbers that the other could find. Overall, Apollo was able to enrich 90 of the phone numbers, while Lusha enriched 78. Comparing numbers side-by-side, there was a small handful of mismatches between both providers for the same prospect; often, this was again in Apollo's favor, as the Lusha number could be found as the corporate number within Apollo.

When we cold-called, we found that 9 of Apollo's 90 numbers and 8 of Lusha's 78 numbers were Bad Data, so Apollo still (effectively) had broader coverage when throwing out bad numbers.

This was a small & biased sample size (salespeople tend to have good data available), so I wouldn't index on it too heavily, except to say that Apollo's data is performant. There were a couple of strange cases (I called a rep at Pilot.com, only to realize I'd called an actual pilot), but overall they didn't hurt the funnel significantly.

How good is the price?

Apollo's credits are reasonably priced, and the per-number cost decreases with volume. At its lowest volume, Apollo offers 50 credits for $10; factoring in the quality and coverage, this is definitely a steal, especially when compared to non-self-serve, enterprise platforms like ZoomInfo.

Is it worth switching?

In our eyes, the biggest strength of Apollo's Sales Intelligence offering isn't the data quality or the pricing (while both are fine, they're not significantly differentiated from the competition). It's the integration with the rest of the workflow. Anyone who knows Elto's sales team knows that we drink the Apollo Kool-Aid, and for good reason; it's amazing how seamlessly you can go from enriching data for a prospect to adding them to a sequence, and then emailing & dialing them. Context-switching constantly and wrangling CSV's is a major killer of sales efficiency, and the layers that Apollo has built on top of their data rival Outreach and Salesloft in their quality and ease-of-use. Apollo is not only much cheaper than subscribing to a data provider (e.g. ZoomInfo) and a Sales Engagement Platform (e.g. Salesloft) at the same time, but it's also a much better experience for the sales rep.

Our verdict

Apollo holds its own as a data provider. While its quality is on-par with other providers (if not slightly better), the quality of its integration with the rest of the platform (as well as the ease-of-use of self-serving into the database and the complexity of its filters) and its reasonable price point (it substituted 4 tools us!) make it very worthwhile. Our recommendation is to use it in tandem with another provider to fill in any coverage gaps (we personally use Apollo.io in tandem with Lusha, but we're always on the hunt for good data, so send recommendations our way!)